Best Merchant Services for 2024

Merchant services are similar to payment processors, but their biggest advantage is the provision of a dedicated merchant account, unlike processors, which usually offer aggregate services.

A dedicated merchant account offers greater account stability, meaning you won’t experience frozen funds or accounts due to changes in payment and processing volumes.

Moreover, the best merchant account providers offer competitive rates and flexible solutions for processing in-person and online payments.

Top merchant services comparison

Processing fees are a key deciding factor when choosing the best merchant service for your business. The table below illustrates the monthly fees, per-transaction fees, and fee structure for each of our recommended merchant services.

Don’t need a dedicated merchant account? See our roundup of the best payment processors, which includes aggregate processors like Square.

Pricing structures explained

- Interchange plus: The processor passes along the exact fees from the credit card networks, adding a small markup on top. This results in more variable fees since the fees from the networks vary depending on card type and transaction type. However, the result is usually lower fees overall.

- Fat-rate: The processor charges the same pre-set fee for every transaction. This model is straightforward and predictable, ideal for new businesses. However, it might result in slightly higher fees, especially for larger businesses.

- Subscription: Similar to an interchange-plus model, but the processor charges a monthly fee and lower per-transaction fees. This model, while cost-prohibitive for small businesses, typically offers a lot of savings for large businesses.

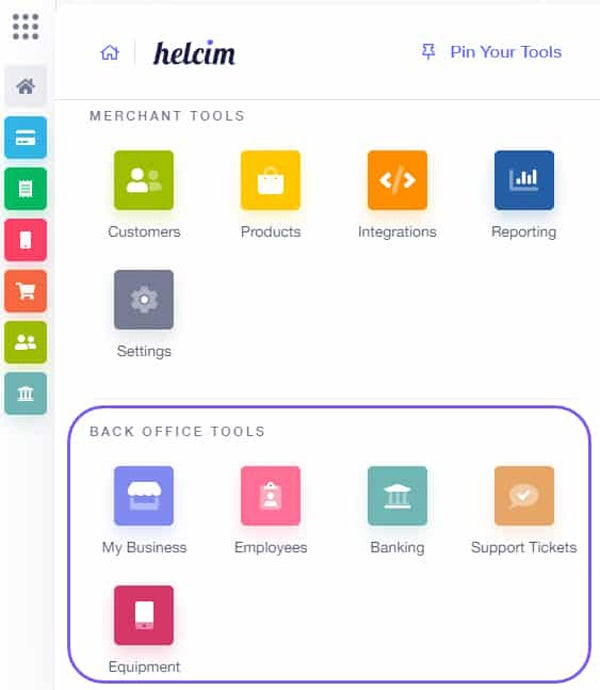

Helcim: Best overall

Our rating: 4.61 out of 5

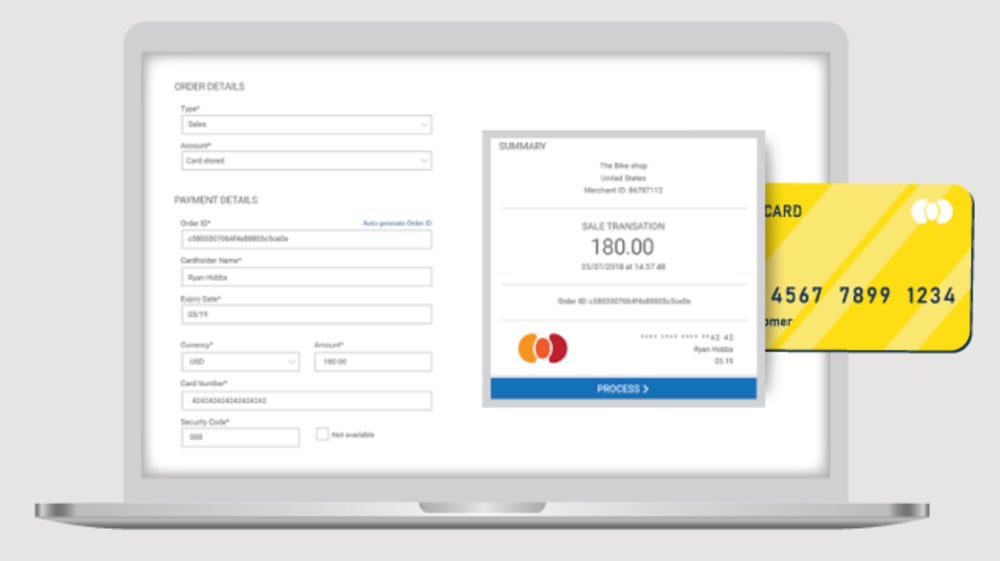

Helcim has an automated volume discount and interchange-plus pricing model with no monthly fees, which is a rare find for a dedicated merchant account. You can consider it an all-in-one merchant account provider. In addition to affordable fees, it supports a wide range of payment options, including Level 2 and 3 credit card data processing for B2B payments.

Why I chose Helcim

Businesses of all sizes will find Helcim’s interchange-plus pricing, automated volume discounts, and zero-cost processing a very affordable option. I have evaluated dozens of merchant service providers, and Helcim’s variety of payment methods is among the best in the market. It can support a wide range of industries, too. Real-world user feedback also praises its high-quality customer support.

Pricing

- Monthly fee: $0

- Payment processing fees:

- Interchange plus 0.15-0.4% and 6-8 cents per card-present transactions.

- Interchange plus 0.15%-0.50% and 15-25 cents per card-not-present transactions.

- 0.10% + 10 cents per transaction American Express surcharge fees.

- 0.5% plus 25 cents, capped at $6/transaction, $5 return fee for ACH payments.

Features

- Interchange-plus pricing with automated volume discounts.

- Hosted payment pages.

- Mobile payment app.

- Virtual terminal.

- Guided chargeback dispute resolution.

- Fee Saver Program – a zero-cost processing program that supports online, invoice, and in-person payments. Helcim automatically detects the free credit card processing program available to use based on the card type/network and business location.

Pros and cons

| Pros | Cons |

|---|---|

|

|

PaymentCloud: Best for high-risk businesses

Our rating: 4.56 out of 5

PaymentCloud provides traditional merchant services in addition to high-risk merchant account services. However, it is best known for high-risk payment processing because it has an excellent reputation for getting businesses approved. PaymentCloud integrates with all payment gateways, so you can use your preferred gateway, or it can help you find a more compatible gateway solution for your business.

Why I chose PaymentCloud

What I like about PaymentCloud is that it takes a very hands-on approach to getting you approved with partner banks and works with multiple payment processors to get you the lowest rates. The company partners with ten banks and has a 98% approval rate.

PaymentCloud can likely approve you even if other merchant account providers have rejected your application. After approval, it helps with onboarding, such as setting up advanced fraud/filtering for your payment gateway.

Pricing

- Monthly fees: $10-$45

- Transaction fees:

- 2%-3.1% for low-risk transactions

- 2.3%-3.4% for medium-risk transactions

- 2.7%-4.3% for high-risk transactions

- Other fees:

- $25 chargeback fee

- Average $15/month for payment gateway

- $15-$45/month for virtual terminal

- 1%-2% cross-border fees

Features

- Supports medium- to high-risk businesses — tobacco, e-cigarettes, topical CBD, electronics, dropshipping, bail bonds, firearms, and more.

- Accepts cryptocurrencies.

- Options for POS systems and full EMV credit card terminals.

- Robust dispute resolution support with Chargeback Gurus.

- Fraud detection tools like Address Verification System (AVS) technology, tokenization, P2PE data encryption, and 3D Secure technology.

Pros and cons

| Pros | Cons |

|---|---|

|

|

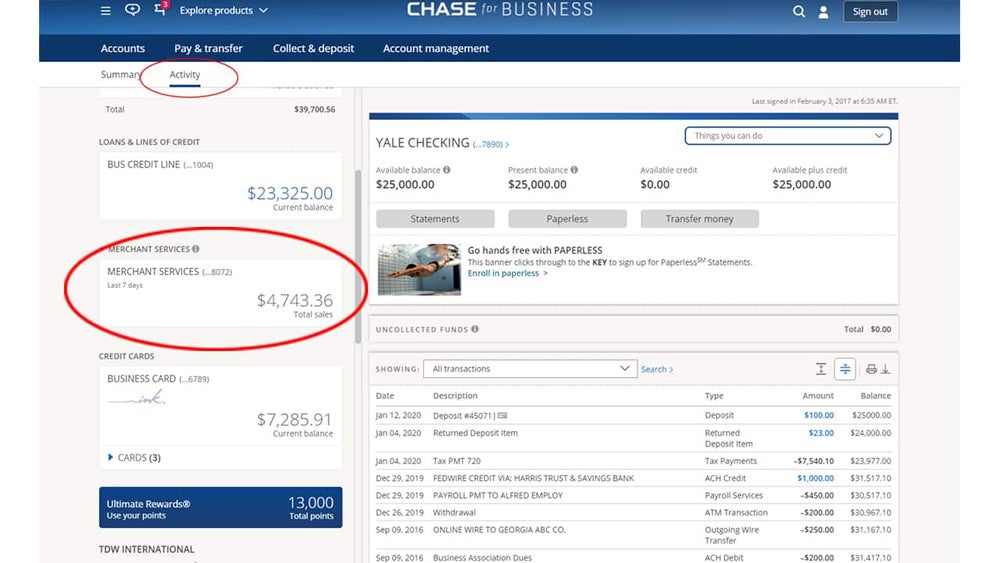

Chase Payment Solutions: Best direct processor

Our rating: 4.55 out of 5

Chase is a renowned banking and financial institution that also offers a merchant account service, Chase Payment Solutions. What sets Chase apart from other providers is that it can leverage its strong banking infrastructure to provide better transaction rates, faster fund transfers, robust insights, and solid security.

Why I chose Chase Payment Solutions

I like that Chase can offer custom interchange-plus rates for qualified merchants — it is actually one of the few direct processors that can rival the fees Helcim offers small businesses. Ultimately, to fully enjoy all of Chase’s features, you’ll need a Chase business checking account. Having Chase as both the processor and receiving bank in transactions can provide better speed and security because of the lack of an intermediary.

Pricing

- Monthly fee: $0

- Payment processing fees:

- 2.6% plus 10 cents for in-person transactions.

- 2.9% plus 25 cents for online transactions.

- ACH processing fees:

- 1% (capped at $25), non reversible, for real time deposits.

- 1% (capped at $25), reversible, for same-day deposits.

- $2.50 for the first 10 transactions, 15 cents for additional, reversible, for standard deposits (1-2 business days).

- Other fee:

Features

- Direct processor.

- Free merchant account.

- Free same- and next-day funding.

- Advanced analytics that offer unique insights (Chase Customer Insights).

- Quick Accept mobile app for in person and over-the-phone payments.

- Chargeback and risk monitoring.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Dharma: Best for transparency

Our rating: 4.45 out of 5

Dharma offers low-cost interchange-plus pricing, with volume discounts for merchants processing more than $100,000 or 5,000 transactions. Overall, Dharma is a well-known processor with an excellent reputation for fairness and transparency.

It also offers flexible hardware options and accounts and support for a variety of business types, including retail, restaurants, in-person, and online businesses.

Why I chose Dharma

Dharma is known for being very transparent in pricing, with every fee listed on its website. Dharma specializes in helping nonprofits, having donated over $750,000 to nonprofits. It has one of the lowest rates for card-not-present transactions. If your business processes at least $10,000 in monthly credit card transactions, Dharma is a good solution for you.

Pricing

- Monthly fee: $15

- Payment processing fees:

- Interchange plus 0.15% + 8 cents for in-person transactions.

- Interchange plus 0.20% + 11 cents for online transactions.

- Interchange plus 0.25% + 8 cents for in-person American Express transactions.

- Interchange plus 0.30% + 11 cents for online American Express transactions.

*Discounts available for merchants processing over $100,000 per month, over 5,000 transactions per month.

- Other fees:

- $49 for account closure.

- $25 chargeback fee.

- $39.95 per month if not PCI compliant.

Features

- Flexible, works with several POS systems such as Clover, Aloha, Lava, and Shopify.

- Free virtual terminal and mobile POS.

- Offline processing.

- Surcharging from the MX Merchant platform (MX Advantage).

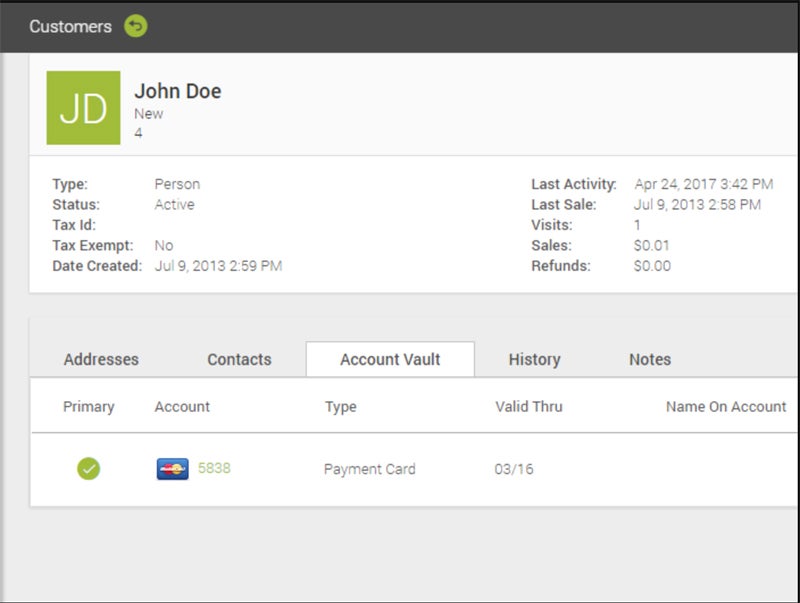

- Robust online reporting.

- Customer database with card-on-file storage.

- Guaranteed two-business-day funding with daily 7 p.m. network cut-off time.

Pros and cons

| Pros | Cons |

|---|---|

|

|

US Bank Merchant Services: Best for fast deposits

Our rating: 4.42 out of 5

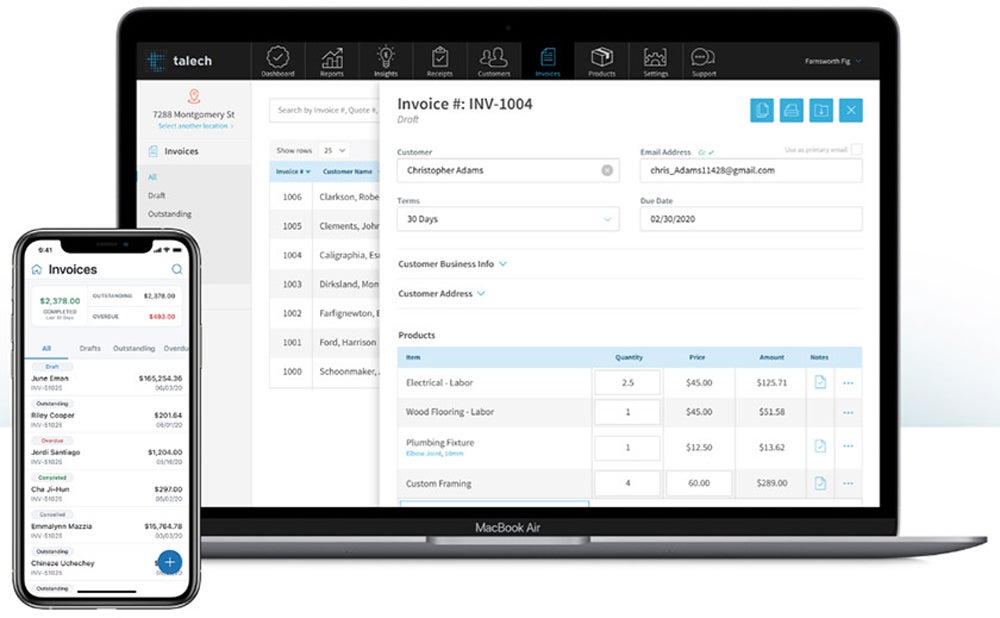

US Bank provides business banking, payment processing, and point-of-sale services. It has its own processing service (Elavon) and POS system (talech) but can work with other payment gateways, ecommerce platforms, and other POS systems. US Bank also processes almost all payment methods, including deposit checks, debit cards, and Zelle business payments.

Why I chose US Bank

Of all the merchant services I recommend, US Bank is the only service providing Everyday Funding. This lets you get funds seven days a week, including weekends, and is available at no additional cost for deposit account customers. Note, though, that same-day funding is dependent on batch times. Activation usually takes three to five business days from the service request date.

Pricing

- Monthly fee: $0–$99.

- Payment processing fees:

- 2.6% + 10 cents per card-present transaction.

- 2.9% + 30 cents per card-not-present transaction.

- 3.5% + 15 cents per keyed-in transaction.

*Custom rates and plans available.

Features

- Everyday Funding — get funding seven days a week, at no additional cost for US Bank business depository account customers with a US Bank payment solutions account.

- Credit card surcharging.

- Cloud-based POS suite — talech.

- Remote deposit capture (RDC).

- Offline processing.

- 24/7 customer support and dedicated account manager.

- Full sales reporting.

Pros and cons

| Pros | Cons |

|---|---|

|

|

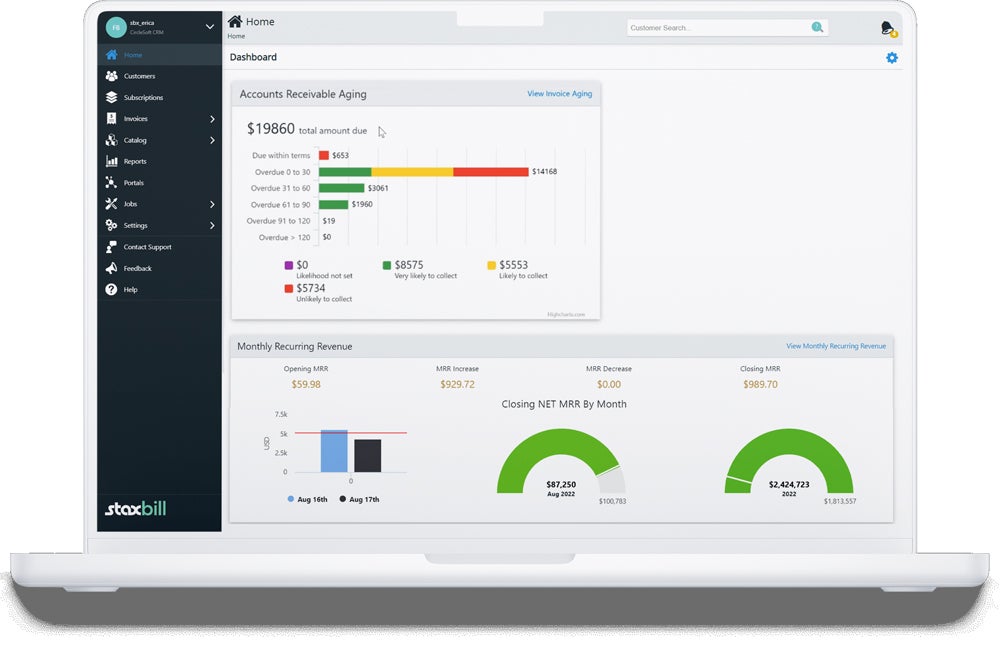

Stax: Best for recurring or subscription billing

Our rating: 4.39 out of 5

Stax offers membership-based interchange-plus pricing that is better-suited for businesses processing more than $10,000 per month. Accept a variety of payment methods—invoicing, hosted payment pages, payment links, QR codes, and a one-click online shopping cart. You can also schedule recurring payments and get compatible hardware from other POS providers. Stax also offers surcharging through its sister company, CardX, which allows you to legally pass along processing fees to customers.

Why I chose Stax

Stax has outstanding features tailored for subscriptions and recurring billing. You have access to secure card-on-file payments, advanced CRM, and self-service customer portals. One of the features you also do not usually get with recurring billing are short message service (SMS) text-to-pay solutions and robust reporting — something you get with Stax.

Pricing

- Monthly fees:

- $99 for businesses that handle transactions up to $150,000 per year.

- $139 for businesses that handle transactions between $150,000 and $250,000 per year.

- $199 for businesses that handle transactions more than $250,000 per year.

- Payment processing fees:

- Interchange plus 8 cents per card-present transaction.

- Interchange plus 18 cents per card-not-present transaction.

Features

- Wholesale interchange-plus pricing.

- One-click shopping cart.

- Customer relationship management (CRM).

- Stax Bill — invoicing and recurring billing with self-service portal.

- Surcharging through CardX, Stax’s sister company.

- Stax Connect — dispute management.

Pros and cons

| Pros | Cons |

|---|---|

|

|

How do I choose the best merchant services for my business?

As with all payment services, the best merchant service will depend on the types of services your business needs. Some merchant services are more compatible with certain businesses than others. Know your payment methods, which tools you need (invoicing, recurring billing, virtual terminal, POS hardware, etc.), and which ones match your required business integrations, like accounting software. It is also important to think about security features and chargeback management.

Methodology

I evaluated dozens of merchant services and scored them using our in-house rubric of 19 data points across categories like pricing and contract requirements, features, security, and stability. I also factored in our own experience and feedback from real-world users. Finally, I only included merchant services that offer direct merchant accounts, which provide more security and stability.

This article and methodology were reviewed by our retail expert, Meaghan Brophy.

Source link